Pegasus Knowledge Center

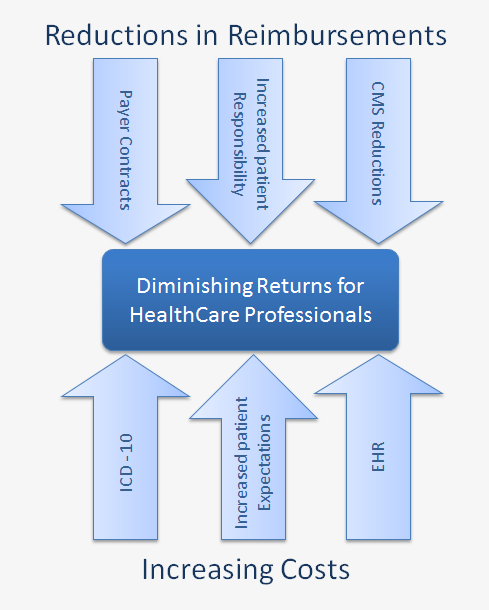

Hospitals, Medical Practices, and Healthcare Organizations are all experiencing pressures to their bottom line. Many Hospitals are bankrupt or nearly so. Healthcare providers are looking at a bleak future for earnings growth, even though they will be serving more patients. The major factors contributing to this dismal picture are patient expectations, government regulations, and reimbursement rules and contracts that limit charges and increase costs of doing business.

For many in the healthcare industry this picture is depressing and increasing numbers of practices and institutions are selling out and handing their futures to large corporations. There is another avenue that will deliver strong returns and still allow the practice or institution to maintain its independence. Over the past decade the trend toward outsourcing non-medical processes to third party suppliers has been increasing. This trend has spawned the growth of a very competent and cost effective Revenue Cycle Management (RCM) industry. Today there are a few large, well run, and highly effective organizations that provide billing services and a host of innovative ancillary services to healthcare practices nationwide at a cost that is below the internal cost to these organizations. In fact, cost is not even the biggest driver when it comes to deciding to outsource business practices. The increased efficiency provided by these third party experts lead to impressive gains in payments and reductions in time to payment, resulting in much improved bottom line.

Because of these emerging opportunities to improve the performance of our healthcare practices we feel it is a good time to take a look at the whole issue of Outsourcing vs. Insourcing non-clinical business processes. The first step is to understand the non-financial drivers that impact the decision to outsource. The table below provides a high level overview of the major drivers based on feedback from a wide range of healthcare practices ranging in size from single provider to hundreds of providers in areas such as: physical therapy, labs, medical specialty practices, hospitals, Group Healthcare Organizations, etc.

Non-Financial Drivers Impacting the Decision to Outsource Business Processes |

|

|---|---|

Driver Description |

Considerations Impacting Decision |

Quality of Service |

What is the difference between the quality of service provided to the patient/practice today vs. the expected quality of the service provided by a third party |

Transparency of Operations |

What is the impact on transparency of operations? For example: The outsource provider may have superior reporting and analytics, or they may not provide the control required by the practice managers. This driver is all about the management team having visibility and control over each step and deliverable in the process. |

Staff Training Needs |

How much training will be required by the staff with outsourcing, vs. how much training is required to retain the process in-house. Issues similar to ICD-10, staff turn-over, and changes to payer contracts/CMS are key components of this driver. |

Staff Absence |

The impact of staff absences on practice efficiency, management lost time addressing the missing resource, along with the impact on cash flow make staff absence an important driver. |

Existing Process Efficiency |

Lack of efficiency and reduced productivity often drive a practice to outsource rather than try to fix a broken process |

Existing Technology |

Outsource providers usually have efficient state of the art technology to support their processes. Due to economies of scale, the outsource provider can cost effectively own and maintain world class solutions that improve performance and accelerate deliverables. Most healthcare practices have a difficult time justifying this level of investment for a business of their size. |

The financial component of an outsource decision is always dependent on the specifics of the individual business, however, most business have a great deal in common, because the healthcare industry has been mired in heavily manual and paper driven processes for decades. The following is a typical example of how the financial analysis may be approached. For simplification we will use the billing process of a large and relatively well run medical practice. An example of a poorly run practice could result in up to a 20% savings in cost alone. Although this example is modeling the billing process; the financial analysis for every potential outsource process would be similar. The numbers used in this example are based on industry benchmarks.

In this model we assumed that the increase in collections will be only 3.75% because that is the industry minimum for reimbursement increases when billing is turned over to professional RCM companies. It should be pointed out that this financial model is very simplistic and does not attempt to demonstrate that the savings can be enhanced when the cost of training and temporary help during staff absence. In fact many practices report that ICD-10, EHR, Payer contract changes, Reimbursement rule changes, and new governmental regulations, are creating a night mare of on-going training requirements for their staff. Practices in areas that experience high staff turnover experience recurring costs of training new staff as previously trained staff members leave the practice.

The example above analyzes just the billing process; however many Healthcare organizations require support services for more than just their billing process. In fact; many practices need technology tools and support in addition to process support. Today there is a wide array of third party providers that can help a practice with their support needs. The most frustrating thing for a practice manager is the fact that most of these support providers only focus on a few elements of a total improvement approach. For example: One company will provide a patient portal and an EHR system, another will provide RCM services, and yet another will provide practice consulting services. While this "best of breed" approach is appealing for some, most practice managers tell us that the multiple vendor selection processes and the large integration projects that result from using different vendors to supply the various needs of their business result in added integration and training costs and sub-optimal automation and workflows. Several Healthcare Industry leaders we spoke to mentioned that only 2 or 3 of the largest Healthcare Service Providers offer a full range of outsourced processes. As the CEO of Pegasus Blue Star Fund, a private equity fund specializing in Healthcare Services Investments, I have over 20 years of experience investing and managing Healthcare Services companies in the areas of Cancer treatment centers, Surgery centers, Practice management, Medical Group Purchasing Organizations, EHR, Medical Revenue Cycle Management, Patient Portal, Claims Optimization, Claims Authorization, Patient collections, Bad debt collections etc. Early in my career I was the CEO and chief business architect for the Pegasus Consulting Group. I had the opportunity to coach the executives from many Fortune 100 businesses in process optimization, and automation, helping them to make dramatic improvements to their bottom lines. As I moved into the Healthcare Business I immediately realized that the industry was in dire need for process improvement and automation to meet the rapid pace of change in the industry. As CEO of Constellation Healthcare Technologies, one of the top 5 largest RCM companies in the US, I responded to this pressing need by assembling an integrated suite of holistic and fully automated support services and technologies that Healthcare Practices, Hospitals, and Medical Specialty Practices can use to improve their weak areas and bring world class quality to patient care and industry leading financial results to their bottom line. This fully integrated approach to supporting the needs of Healthcare Practices is very attractive to practice managers because it provides one stop shopping for practice support needs while at the same time delivering consistent and fully integrated solutions, which reduces implementation and training costs dramatically. We have compiled a list (please see the table below) of some of the major technologies and support services that are available today to help the Healthcare Practices improve their bottom line.

Support Services and Technologies |

|---|

Revenue Cycle Management |

Coding |

Transcription |

Electronic Health Records |

Patient Portals |

Business Intelligence

|

Practice Audit

|

Practice Management

|

Group Purchasing Organizations to provide economies of scale to small practices by consolidating clients from around the nation. |

Healthcare Management Consulting |

The obvious question at this point is how can a Healthcare Practice Manager determine which of their processes to consider for outsourcing and which of their processes should remain in-house? Dale Brinkman, CEO Orion HealthCorp, and Jamie Kerestes, CEO NEMS, are both highly regarded Healthcare experts. Recently they collaborated on a medical practice assessment, and then graciously shared with us the approach they used to determine which process required improvement and which processes should be considered for outsourcing. Although their methodology is proprietary, they did share some of the high level elements of their methodology.